IDF Loans

Get discounts on unpaid invoices

With our Invoice Discounting Finance loans, vendors, suppliers, and corporates can clear out unpaid invoices for supplies in advance. Don’t delay business growth initiatives because your buyers have not paid.

No collateral required

We provide business loans without requiring collateral. We believe MSMEs and SMEs should have access to invoice discounting finance without such barriers.

Zero paperwork required

Set up your business profile and apply for loans effortlessly, at your comfort, from anywhere in the world.

48-hour turnaround time

We’ll respond to your application within 24 hours and disburse funds within 48 hours of approval.

No guarantors required

Our proprietary algorithm evaluates and scores transactions, sources appropriate financing, and ensures final settlement, removing the need for a guarantor.

Loans up to 1bn

Whether big or small, we finance projects and business initiatives of all sizes. Tell us the amount you need—we’ve got you covered.

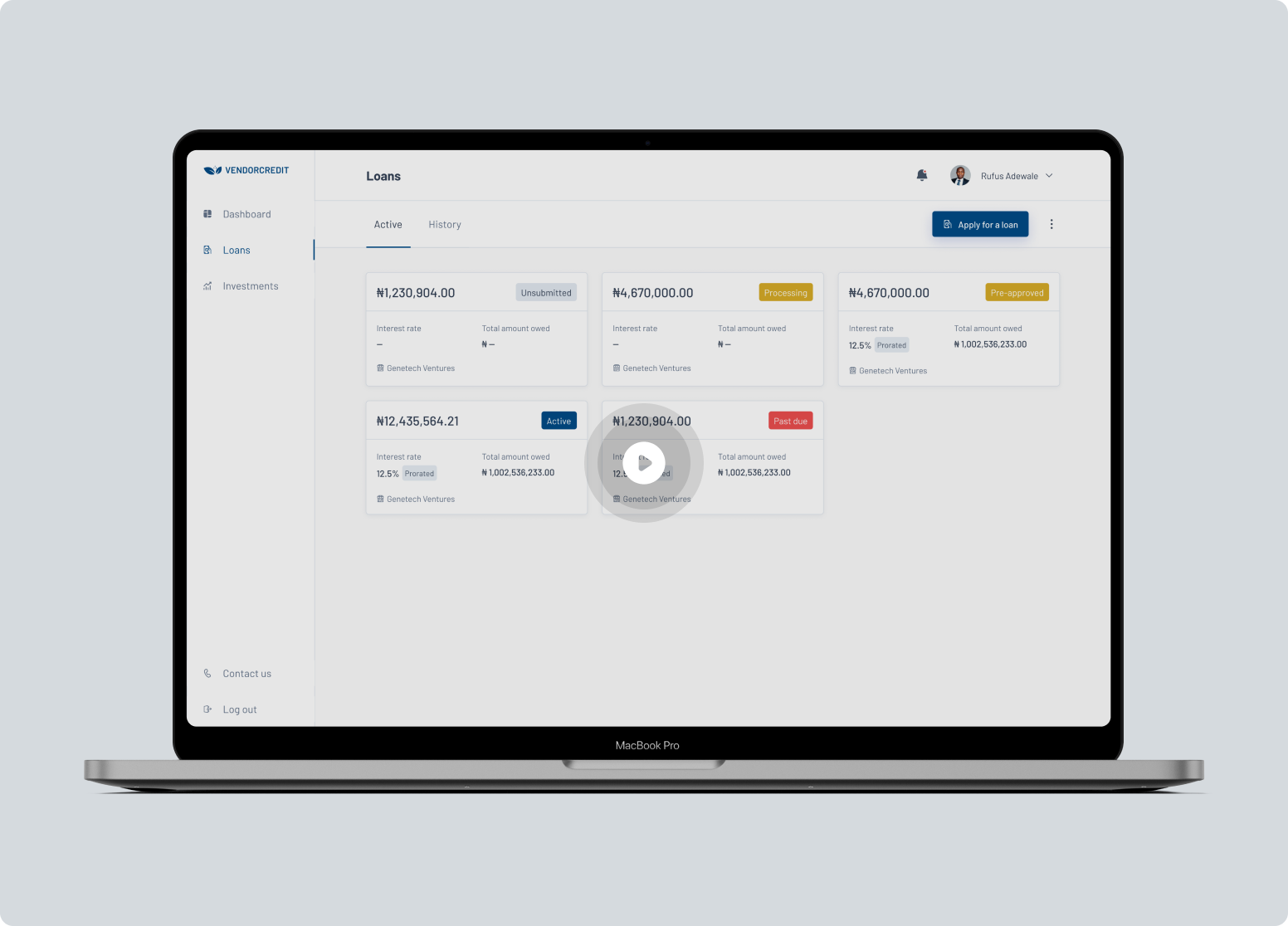

Apply in 3 Steps

Follow these steps to secure a loan with a 48-hour turnaround.

Step 1

Register and verify documents

Use our web platform or our Android mobile app and follow the steps to create an account for your business(es) in minutes. After registering, upload the necessary documents to verify your identity and financials. We will confirm their accuracy promptly.

Step 2

Request loan and get offer

Once your account is set up, you can submit a loan request right away. Upon successful verification, you will receive a tailored loan offer. Our team will guide you through the terms within a few hours.

Step 3

Receive disbursement

Once you accept the offer, the loan amount will be disbursed quickly into your account, typically within hours.

Frequently asked questions

Everything you need to know about Working capital loans

VC is a short form of Vendorcredit which some of our customers think sounds cool. Nevertheless, we are a government-licensed fintech offering products focused on providing solutions to optimize supply chains across Africa. Thus far, we have disbursed over $ 10 million.

Get funding now

Create an account now to get started on funding your purchase orders.